Featured

Risk Parity Portfolio Example

Risk Parity Portfolio Example. Today we will use a similar example, but switch to indexes (and back testing in the case of qspix) to look at some hypothetical portfolios over a longer period. The risk parity approach to portfolio management centers.

% compute the risk parity portfolio within each cluster. Risk parity is an investment management strategy that focuses on risk allocation. The past 15 years have marked one of the longest bond.

Recently, A Great Number Of Approaches, Trying To Differentiate Themselves From The Markowitz Approach.

The risk contribution of asset i is computed as follows: The volatility of the portfolio is defined as: % compute the risk parity portfolio within each cluster.

In His Latest Study, Dr.

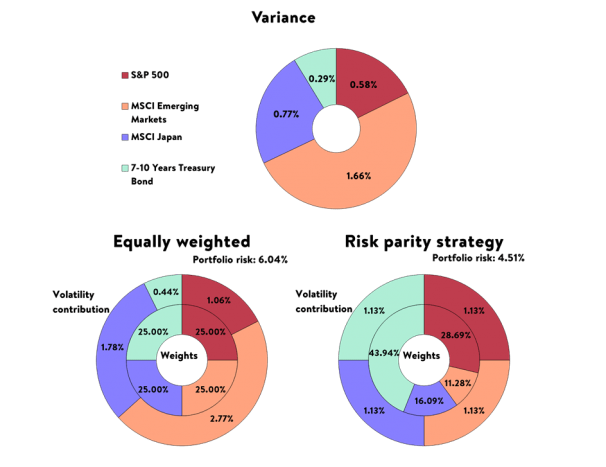

Risk parity (or risk premia parity) is an approach to investment management which focuses on allocation of risk, usually defined as volatility, rather than allocation of capital. Let’s consider a simple example to illustrate how rp works. As a simple example, let's say you had a choice of two portfolios.

See Lopez De Prado, M.

Of course, similar to all strategies, there must also be certain downsides and the risk parity strategy is no exception. In case when you have a dozen of stocks and at least some of them from the same industry, say energy, the instability becomes a real issue. Risk parity portfolios can also match the returns of the total stock market with less volatility and drawdowns.

As Of May 2018, More Than $175 Billion Of Assets Are Managed Using Risk Parity Strategies According To Bloomberg.

For example, while electronics like smartphones might appear to be a luxury good, they just might end up being considered completely essential soon. Within a 0.1 range) but not so well when the sharpe ratio of the various asset. For example, as shown below, in a typical 60/40 portfolio, equity risk accounts for almost 90% of the total risk of the portfolio, which is significantly higher than

Now, There Will Be Shouts Of Disagreement.

(4) the risk parity ultimate portfolio; The main aim is to find such weights of assets that make up a portfolio to ensure an equal level of risk. % get the problem information.

Comments

Post a Comment